Systeme.io Affiliate Program

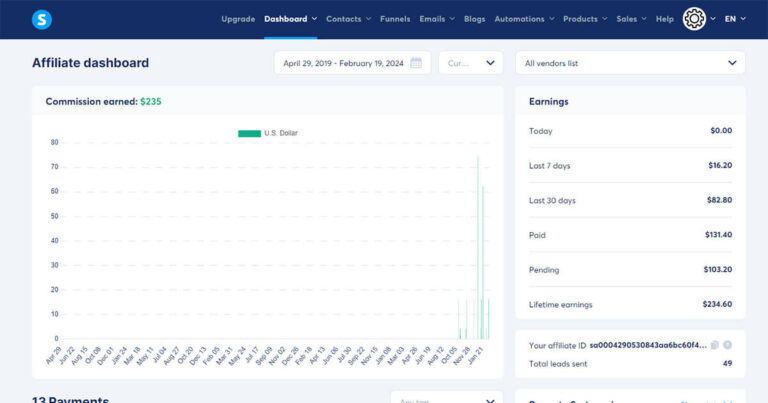

Discover below our in-depth Systeme.io affiliate program review: What Is the Systeme.io Affiliate Program? This is a lifetime affiliate program…

Discover below our in-depth Systeme.io affiliate program review: What Is the Systeme.io Affiliate Program? This is a lifetime affiliate program…

Explore the Systeme.io dashboard walkthrough here: Dashboard Main Dashboard The main dashboard in Systeme.io provides an overview of your entire…

Discover below the ultimate Systeme.io tutorial for beginners: Systeme.io Step by Step Video Tutorials Method #1: Watch the full playlist…

Uncover here Systeme.io PLR package reviews with access to 8 courses: How to Make Your First $1,000 Online You can…

Unlock below (Done-For-You) Systeme.io funnel templates: Note: It is necessary to be logged in to your account before unlocking Systeme.io…

Unlock here what is the best free alternative to Unbounce: What Is the Best Free Alternative to Unbounce? Systeme.io is…

Unlock below what is the best free alternative to Landingi: What Is the Best Free Alternative to Landingi? Systeme.io is…

Unlock here what is the best free alternative to MailerLite: What Is the Best Free Alternative to MailerLite? Systeme.io is…

Unlock below what is the best free alternative to Gumroad: What Is the Best Free Alternative to Gumroad? Systeme.io is…